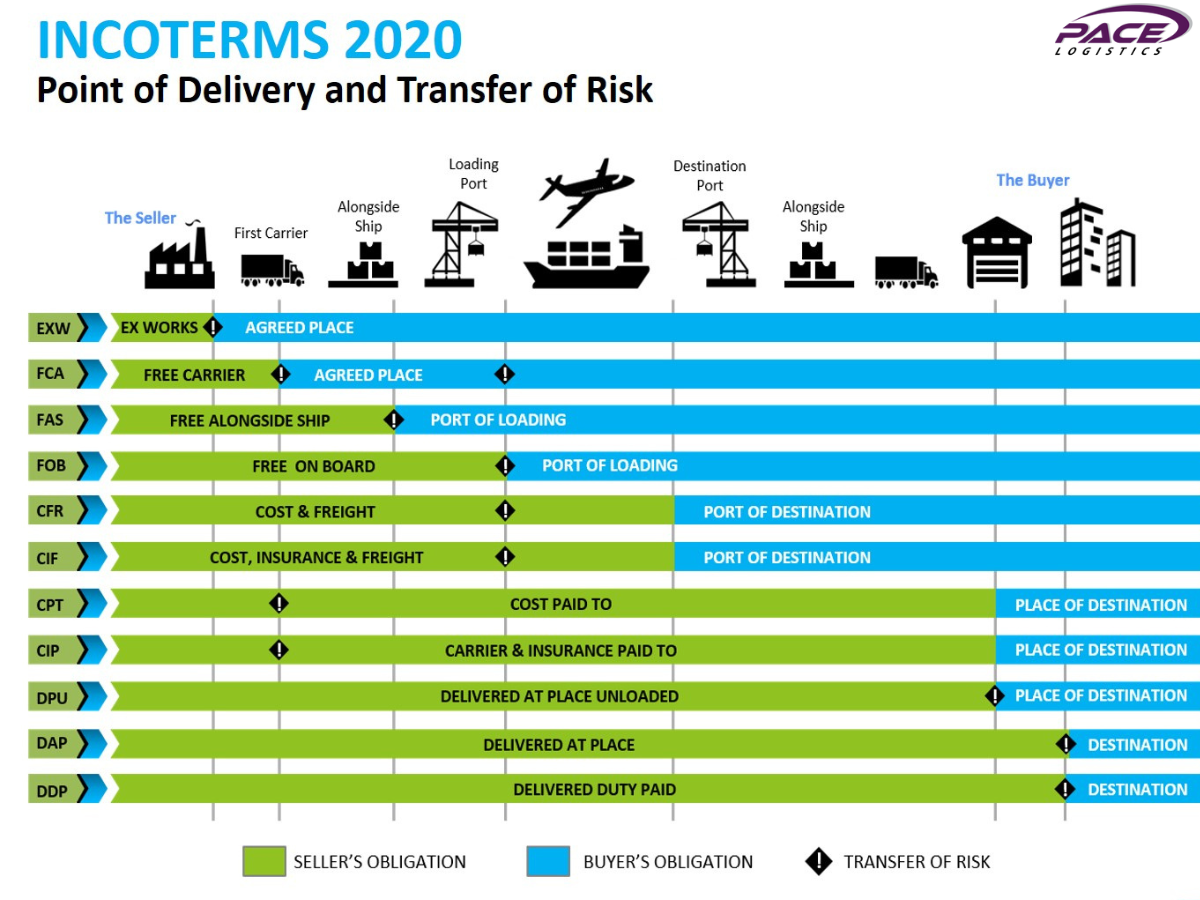

International exchange can be complex, especially in terms of expertise, duties, fees and risks involved in transporting items. Incoterms (International Commercial Terms) is a set of regulations published by the International Chamber of Commerce (ICC) to standardize these components. The Incoterms 2020 version brings clarity and precision to alternative solutions worldwide. Let’s explore the key Incoterms in this guide. We will explain Incoterms their key points and help you select shipments worldwide.

What are Incoterms 2020?

Incoterms 2020 is a set of internationally recognized terms changes published through the International Chamber of Commerce (ICC). They act as a common language for global transactions and define the responsibilities of consumers and sellers. The latest version is Incoterms 2020, which entered into force on January 1, 2020. There are a total of 11 Incoterms, each with responsibilities for the buyer and the seller.

Ex-works (EXW)

Ex-Works transfers most of the responsibility to the buyer. The seller will ensure that the goods are at the seller’s premises or at another specified location. Where the buyer loads and clears the goods for export. It represents the lowest price that the seller provides. The most used in transport is incoterms.

Free On Board (FOB

Fob Incoterms is when the seller delivers the goods along the vessel specified by the buyer. The responsibility rests with the buyer once the goods are on board the vessel. The Incoterm is widely used for inland and waterway transport. This incoterm represents a good balance between the responsibility of the buyer and the seller. In FOB incoterms, the buyer must be clear about the specific port of shipment.

Free Carrier (FCA)

This incoterm is similar to Ex-Works. The seller delivers the goods either to the carrier, to an authorized person at the seller’s premises or to another agreed location. The point at which any risks pass to the buyer must be clearly defined.

Delivered Duty Paid (DDP)

This applies to cases where the seller bears responsibility for all costs and risks associated with the delivery of the goods to the buyer’s specified destination. This includes clearance of goods for export and import, payment of any customs duty and handling of customer formalities. DDP is good for consumers who need minimal involvement in the import method. Regularly used for high value items or situations.

Duty Delivered Unpaid (DDU)

This is an international business term that means that the seller will deliver the goods as soon as they are available at the agreed place in the country into which they are imported.

Cost Insurance and Freight (CIF)

This is similar to CFR incoterms. The difference is that the seller takes out insurance against the risk of loss or damage to the buyer. Both of these terms refer to waterway transport. This incoterm provides financial protection to the buyer.

Cost and Freight (CFR/CNF)

The seller is responsible for transporting the cargo to the buyer’s port. Once the goods arrive at the port, the responsibility passes to the buyer. The buyer must then unload the cargo and bring the goods to the country of destination, followed by importation and delivery to the final destination.